News

07/09/2025, San Ramon CA

Tax Talks with Larry: Self-Directed IRAs and Special Cases

Tax Talks with Larry: Self-Directed IRAs and Special Cases

Upcoming Live Webinar

Join us for the next session in our Tax Talks with Larry series, where we explore how Self-Directed IRAs

can empower investors to save on taxes, access unique opportunities, and build wealth in alternative

assets.

Date: Friday, July 18th

Time: 12:45 p.m. Pacific Time

Location: Online – Zoom (registration required)

What We'll Cover

In this interactive webinar, Larry Pon, seasoned tax strategist, and the AltsCustodian team will share insights on:

-

How Self-Directed IRAs work Funding strategies, account setup, and why more investors are moving beyond traditional retirement accounts.

-

Most popular asset classes Real estate, private equity, private debt, and other high-return investments you can hold in a Self-Directed IRA.

-

Special situations and compliance pitfalls Prohibited transactions, unrelated business taxable income (UBTI), and strategies to avoid or reduce tax exposure.

-

Real-world examples Larry will walk through unique client scenarios and lessons learned from recent case studies.

-

Market adoption and trends How advisors and investors are using Self-Directed IRAs today, and where the market is headed.

-

Q&A Session Bring your questions! We’ll address the most common topics from investors and financial professionals, including discussions from the Financial Planners Association forums.

Whether you’re an advisor helping clients diversify or an investor exploring new ways to grow retirement wealth, this session will give you practical knowledge you can put to work immediately.

Reserve Your Spot

financialplanningassociation-org.zoom.us07/09/2025, San Ramon CA

Why Self-Directed IRAs Are Becoming Essential Tools for Financial Advisors

Why Self-Directed IRAs Are Becoming Essential Tools for Financial Advisors

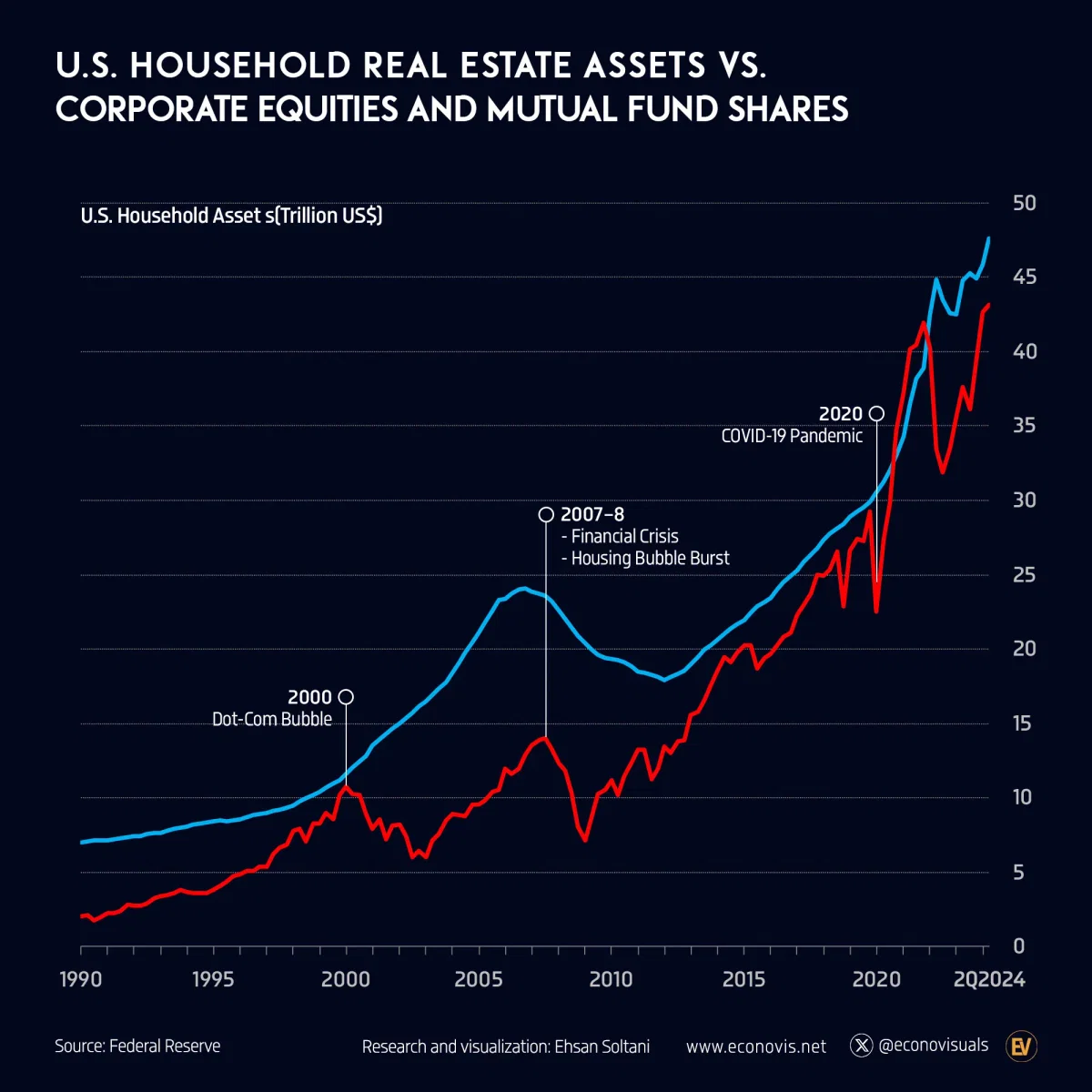

Historically, self-directed individual retirement accounts (SDIRAs) emerged to give individual investors a way to diversify their retirement holdings beyond publicly traded markets. In the years following the 2008 financial crisis, these accounts were heavily used for residential real estate—especially distressed assets that offered compelling opportunities for value and income.

But since then, the landscape has shifted dramatically. SDIRAs are no longer niche vehicles limited to real estate or precious metals. Today, they are increasingly used for private equity, private credit, real estate syndications, venture capital, digital assets, and more. The modern SDIRA has become a bridge between traditional retirement structures and the rapidly growing world of private and alternative investments.

And perhaps the most exciting evolution is how these accounts are now being used by financial advisors themselves—not just by individual investors.

A Misleading Name, A Powerful Tool

Despite the name “self-directed,” these accounts are not solely for do-it-yourself investors. In fact, many SDIRAs are managed in close collaboration with financial professionals. Advisors can use these accounts to help clients allocate funds into non-public investments that align with long-term goals—assets that aren't available through standard custodial IRAs or brokerage accounts.

What distinguishes SDIRAs is flexibility: they allow advisors to offer a wider range of strategies—particularly in the private market—while maintaining the tax-advantaged structure of an IRA. Working with an alternative investment custodian, advisors can maintain control over investment direction, client reporting, and integration with planning tools—without having to confine their clients to ETFs and mutual funds.

In essence, SDIRAs are not only viable for advisors—they’re becoming essential.

Real Enthusiasm from the Field

The growing demand for SDIRAs among advisors, accountants, and estate planners was clearly visible at the recent Triple Treat Mixer, co-hosted by CalCPA’s Peninsula/Silicon Valley Chapter, the Financial Planning Association, and a leading local estate planning council. Held in Silicon Valley, the event brought together a diverse and energized group of professionals from all three fields.

Conversations at the event revealed how eager professionals are to explore the intersection of tax planning, estate strategy, and private investment access. Many attendees were excited by the potential of SDIRAs to combine time-tested tax advantages with access to newer asset categories and alternative strategies.

This strong cross-disciplinary interest confirms what we've seen firsthand: self-directed IRAs are no longer on the fringes—they’re at the center of forward-thinking wealth planning.

Backed by Market Data and Regulation

The broader retirement account landscape is massive—IRAs held approximately $17 trillion in assets as of late 2024 (Investment Company Institute). While SDIRAs account for a smaller slice of that total, interest is accelerating due to client demand for diversification, income generation, and portfolio resilience.

Advisors should be aware that SDIRAs come with important regulatory considerations. The IRS prohibits certain transactions (e.g., self-dealing, investing in assets involving disqualified persons), and advisors must also comply with fiduciary standards set by the Department of Labor for retirement accounts. This includes acting in the client’s best interest and disclosing conflicts of interest.

Fortunately, modern SDIRA custodians—like Alts Custodian—are designed to help both investors and advisors stay compliant while streamlining reporting, titling, and transaction administration.

Conclusion: A Smarter Retirement Framework

The term “self-directed” may imply individual control, but in reality, SDIRAs are one of the most advisor-enabled vehicles in the retirement space today. They allow financial professionals to bring institutional-style investment strategies to retirement clients—whether through real estate, private funds, infrastructure, or other illiquid opportunities.

Events like the Triple Treat Mixer reinforce a clear takeaway: there is strong appetite among professionals to rethink retirement investing. With the right custodian and tools, financial advisors are uniquely positioned to lead that charge—delivering value, diversification, and deeper relationships through the smart use of SDIRAs

04/14/2025, San Ramon CA

Alternative Investments During Times of Downturn

Periods of market downturn often bring anxiety and volatility to investors—especially those heavily exposed to public equities and other liquid assets. In contrast, alternative investments in the private market tend to offer a distinct advantage that asset managers deeply appreciate: resilience in the face of turbulence.

-

Stability Through Illiquidity

One of the most notable features of alternative investments is their ability to maintain value during downturns. Unlike public securities, private assets are not revalued in real time based on market sentiment or daily trading activity. This built-in insulation offers investors peace of mind. Asset managers and investors alike understand that markets are cyclical and that values tend to recover over time. By removing the emotional trigger of rapid, public repricing, private investments help preserve mid- and long-term value—even during a temporary decline in the broader market.

-

Intrinsic Value and Income Focus

When public markets decline, attention often shifts to fundamentals. Many private investments—particularly in sectors like real estate and infrastructure—are structured around income-generating strategies. These future cash flows become the basis for valuation, creating a buffer against short-term price swings. Investors are drawn to the consistency and predictability of income, which supports more stable valuations and offers continued returns even in challenging environments.

-

Valuation Inertia and Strategic Timing

Private market assets don’t react instantly to changes in public markets. Their valuations typically exhibit inertia—meaning they lag behind public market trends. While there is a degree of correlation over the long term, the delay can be strategic. If public markets are declining but expected to rebound, investors who enter the private market during or just before this rebound can potentially benefit from a favorable entry point and upward-trending valuations. Historically, private valuations follow—but on a delay—creating a strategic timing opportunity for long-term investors.

-

The Power of Tax-Deferred Investment Accounts

Pairing private market investments with tax-advantaged accounts like self-directed IRAs or solo 401(k)s can further enhance returns. These accounts allow investors to defer taxes on earnings and shield capital gains, making them an attractive vehicle for long-term investment in alternative assets.

03/22/2025, San Ramon CA

Unlocking Innovation and Alpha

Unlocking Innovation and Alpha: $300 Billion in Self-Directed IRA Investments

What every RIA and asset allocator should know about this fast-growing segment of the alternative investment landscape.

One of the most frequently asked questions in the advisory world today is:

“How much wealth is actually invested through self-directed IRA accounts?”

While the data isn’t publicly reported by any centralized authority, industry estimates put the total at approximately $300 billion. And although this number may seem modest compared to the trillions under traditional custody, it represents a highly strategic and underutilized allocation channel—particularly for those focused on alpha generation and access to emerging asset classes.

The Role of Self-Directed IRAs in Portfolio Construction

Unlike conventional custodians, self-directed IRA platforms allow investments in non-traditional assets—think private equity, real estate syndications, infrastructure projects, oil & gas ventures, and even early-stage healthcare companies. These are asset classes that are often out of reach for institutional custodians due to compliance frameworks or asset eligibility restrictions.

For RIAs and asset allocators seeking differentiated exposure and true portfolio diversification, this space can offer a meaningful edge.

A Breeding Ground for Investment Innovation

Many of today’s institutional-grade asset classes were once niche investments discovered and validated within the self-directed ecosystem. These accounts serve as incubators of innovation, where new deal structures and alternative strategies are tested by agile investors before scaling into institutional vehicles.

By the time institutional money enters, much of the early alpha has already been captured by the self-directed segment. This positions RIAs and forward-looking allocators to add tremendous value for clients by identifying opportunities earlier in the cycle—before they become mainstream.

Direct Investing: Reduced Friction, Increased Control

Another unique characteristic of self-directed IRAs is the ability to engage in direct investments, avoiding the management fees, fund layers, and carry structures associated with large funds. This translates to greater transparency, reduced friction, and better control over client portfolios—all while aligning with the fiduciary goals of maximizing return and minimizing cost.

Why It Matters for Advisors Today

In an era where personalization, differentiation, and access define the advisor value proposition, self-directed IRA strategies offer a way to stand out. Whether your clients are high-net-worth individuals seeking exclusive access, or you’re building multi-asset portfolios with an eye on innovation, understanding and leveraging this $300 billion market could be a critical edge.

Key Takeaways for RIAs and Asset Allocators:

-

Estimated $300B in assets invested via self-directed IRAs

-

Access to illiquid, alternative, and emerging asset classes

-

Strong alignment with goals of alpha generation and fee efficiency

-

Early access to opportunities before they scale to institutional channels

-

Direct investment capabilities reduce cost and enhance control

Interested in integrating self-directed IRA strategies into your client offering?

Let’s talk about how to unlock access, improve efficiency, and bring differentiated investment opportunities to your clients.

03/17/2025, San Ramon CA

How to Invest in Real Estate Using a Self-Directed IRA

Real estate has long been a favored asset class for building wealth, offering opportunities for both active and passive investors. When combined with a self-directed IRA (SDIRA), real estate investments can also provide significant tax advantages. Here’s a breakdown of the most effective ways individuals can use their IRA accounts to invest in real estate.

-

Direct Investment in Real Estate

One of the most hands-on ways to invest in real estate using an IRA is direct property ownership. Investors can purchase:

-

Residential homes for rental income or appreciation

-

Commercial properties like office spaces or retail units

-

Fix-and-flip projects where properties are renovated and resold for a profit

Using a self-directed IRA, investors can buy, rehab, and sell properties while enjoying tax-deferred (traditional IRA) or tax-free (Roth IRA) growth. However, it’s essential to comply with IRS regulations, such as avoiding self-dealing (e.g., personally living in or managing the property).

-

-

Long-Term Rental Strategies

For those looking for steady, passive income, long-term rental properties can be a great option. Investors typically pool funds with others into a structured entity like:

-

LLCs that own rental properties

-

Small real estate syndicates that manage a portfolio of rentals

By using an SDIRA, individuals can earn rental income while benefiting from tax-advantaged growth. Unlike flipping, this approach requires less direct involvement, making it ideal for investors seeking passive wealth accumulation.

-

-

Investing in Real Estate Funds

For an even more passive approach, investors can use their IRA funds to invest in:

-

Private real estate investment funds

-

Real estate-focused private equity firms

-

REITs (Real Estate Investment Trusts) in a self-directed IRA

These funds pool investor capital to acquire and manage multiple properties, allowing investors to diversify without managing individual assets. Many funds offer predictable returns, typically generated from rental income, and they cross-subsidize properties to mitigate risk.

-

Choosing the Right Strategy

Individuals can combine different real estate strategies to balance:

-

Higher returns from flipping or value-add investments

-

Stable, passive income from rental properties

-

Diversified income streams from fund investments

Regardless of the chosen strategy, the smartest move is to utilize an IRA account—particularly a self-directed IRA or Roth IRA—to maximize tax advantages and long-term wealth growth.

Interested in exploring real estate investment through an IRA? Speak with an alternative investment custodian today to unlock tax-advantaged opportunities in real estate!

02/27/2025, San Ramon CA

Maximizing Your Portfolio: Partnering IRA Money with QSBS Investments for Optimal Tax Efficiency

Investing in alternative assets, startups, and private equity can generate substantial wealth—but only if structured correctly. The right strategy can eliminate capital gains taxes, maximize retirement savings, and optimize cash flow. By combining Qualified Small Business Stock (QSBS) investments with Self-Directed IRA (SDIRA) strategies, investors can build a tax-efficient portfolio that balances high-growth opportunities with long-term wealth preservation.

In this guide, we’ll explore how to partner IRA money with QSBS investments to create the perfect portfolio for long-term tax efficiency.

The Two Most Powerful Tax Advantages: QSBS & IRA Investing

-

Qualified Small Business Stock (QSBS) – The Ultimate Tax-Free Investment

The QSBS exemption (under Section 1202 of the U.S. tax code) allows investors to exclude up to 100% of capital gains on the sale of qualified startup stock, provided they meet these criteria:

-

The investment is in a C-Corp with less than $50M in assets at the time of investment.

-

The investor holds the shares for at least five years.

-

The business operates in a qualifying industry (e.g., tech, healthcare, manufacturing).

-

-

Self-Directed IRA (SDIRA) – Tax-Advantaged Growth for Alternative Investments

A Self-Directed IRA (Traditional or Roth) allows investors to hold private equity, real estate, and startups inside a retirement account. The tax benefits depend on the account type:

-

Roth IRA: Investments grow tax-free, and withdrawals are 100% tax-exempt in retirement.

-

Traditional IRA: Investments grow tax-deferred, and taxes are paid upon withdrawal.

-

How to Combine QSBS and IRA Investments for Maximum Tax Savings

Many investors wonder: Should I invest in a startup using my IRA or personal funds? The answer depends on the startup’s QSBS eligibility and the type of returns expected. Below, we outline the ideal strategy for different asset classes.

-

Investing in Startups: QSBS vs. Roth IRA

When investing in early-stage startups, choosing the right account is crucial.

Investment Type

Best Account Type

Tax Benefit

QSBS-eligible Startup

Taxable (Personal, Trust, or LLC)

100% capital gains exclusion after 5+ years

Non-QSBS Startup

Roth IRA

100% tax-free growth

Venture secondaries or pre-IPO Shares

Roth IRA or Checkbook IRA

Tax-free or tax-deferred growth

Example:

-

You invest $200,000 in a QSBS startup using personal funds and hold for 6 years.

-

The company exits for $5 million, and your $4.8 million gain is completely tax-free under QSBS.

-

If you had invested through an IRA, the QSBS exemption wouldn’t apply—you would still owe tax on Traditional IRA withdrawals or be limited by Roth IRA contribution caps.

Takeaway: Use personal or taxable accounts for QSBS investments and Roth IRA for non-QSBS, high-growth startups.

-

-

Private Equity & Venture Funds: Best for SDIRAs

For investors looking at private equity funds, debt funds, or real estate-backed investments, Self-Directed IRAs (SDIRAs) provide an ideal tax shelter.

Why?

-

These investments don’t qualify for QSBS (since funds aren’t “active businesses”).

-

IRA structures eliminate immediate tax burdens on fund distributions and capital gains.

Example:

-

You invest $250,000 in a private equity fund inside an SDIRA.

-

The fund returns 4x in 8 years, growing to $1M tax-deferred.

-

If held in a Traditional IRA, you pay taxes only upon withdrawal—or tax-free in a Roth IRA if converted early.

Takeaway: Use SDIRAs for passive income investments like PE, debt funds, and real estate.

-

-

Pre-IPO & Secondary Market Investments: Ideal for Roth IRA or Checkbook IRA

If investing in late-stage pre-IPO companies (e.g., SpaceX, Stripe, Databricks), using a Roth IRA or Checkbook IRA ensures tax-efficient compounding.

Best for:

-

Restricted stock purchases before IPOs.

-

Startup secondaries and employee share liquidity events.

-

Venture debt funds with growth potential.

Example:

-

You invest $150,000 from a Roth IRA into pre-IPO shares of a fintech startup.

-

The company IPOs at a $5 billion valuation, and your stake grows to $2 million.

-

Because it’s inside a Roth IRA, all gains are tax-free.

Takeaway: Use Roth IRA for high-growth pre-IPO investments to avoid capital gains taxes.

-

-

Real Estate, Crypto, and Hard Assets: Best for Checkbook IRA

For investors interested in real estate, crypto, or other alternative assets, a Checkbook IRA (a self-directed IRA with an LLC) provides greater control and tax efficiency.

Best for:

-

Real estate syndications & rental properties.

-

Cryptocurrency investments inside an IRA.

-

Alternative lending & peer-to-peer investments.

Example:

-

You use a Checkbook IRA to buy a rental property inside a tax-free Roth IRA.

-

Rental income and appreciation grow tax-free, and you sell it in 10 years with zero tax liability.

Takeaway: Checkbook IRAs allow for tax-advantaged alternative asset investments.

-

Creating the Perfect Portfolio: A Balanced Strategy

Here’s how you can diversify your investment capital to leverage QSBS and IRA benefits.

Investment Type

QSBS (Personal Funds)

Roth IRA / Roth 401(k)

Traditional IRA / SDIRA

Checkbook IRA

Early-Stage Startups

(for QSBS tax-free gains)

(if not QSBS eligible)

(if fast-moving deals)

Venture & PE Funds

(for tax-free growth)

(for tax deferral)

Pre-IPO / Secondaries

(if QSBS eligible)

(for tax-free gains)

(for fast execution)

Private Real Estate

(for tax deferral)

(for active investing)

Crypto & Hard Assets

(for tax-free growth)

(for direct trading)

Final Takeaways

To build an optimized, tax-efficient investment portfolio, follow these steps:

-

Use personal or trust accounts for QSBS startup investments to maximize 100% capital gains tax exclusions.

-

Invest non-QSBS startups via Roth IRA to ensure tax-free growth.

-

Use SDIRA for private equity, venture debt, and real estate funds to defer taxes on passive income.

-

Utilize a Checkbook IRA for quick capital deployment in crypto, real estate, and pre-IPO secondaries.

-

Convert Traditional IRA assets to Roth IRA before a big valuation spike to avoid future taxes.

By combining IRA strategies with QSBS investments, investors can eliminate capital gains taxes, grow wealth tax-free, and structure a portfolio that thrives in any market condition.

Need Help Structuring Your Tax-Optimized Portfolio?

If you’re looking to invest in startups, private equity, or alternative assets, we can help you structure your investments for maximum tax efficiency. Contact us today to build a customized investment strategy that leverages QSBS and IRA advantages!

01/31/2025, San Ramon CA

Using Tax-Advantaged Strategies to Build Wealth with Alternative Investment Custody

Bernstein Private Wealth Management recently collaborated with the California CPA Association to host an event focused on tax optimization strategies for individuals and families looking to build wealth. The event highlighted the benefits of using trust structures, self-directed custodians, and alternative investment custody solutions as essential tools for long-term tax planning and wealth preservation.

The Power of Trusts, Self-Directed IRAs, and Alternative Investment Custody in Tax Planning

A strategic combination of trusts, self-directed custodians, and alternative investment custody solutions provides unique opportunities for investors to:

-

Minimize tax liability over their lifetime

-

Preserve and grow assets in a tax-efficient manner

-

Ensure smooth wealth transfer to future generations

By leveraging self-directed IRAs (SDIRAs) through alternative investment custody, investors gain the flexibility to diversify their portfolios into real estate, private equity, and other non-traditional investments—all while benefiting from tax-deferred or tax-free growth.

Qualified Small Business Stock (QSBS) & Tax Savings for Business Owners

For business owners, Qualified Small Business Stock (QSBS) strategies can provide significant tax savings. When a business reaches a certain valuation, QSBS treatment allows owners to reduce or even eliminate capital gains taxes upon the sale of their business.

Additionally, self-directed IRAs—especially Roth IRAs—can be leveraged in the early stages of business planning to:

-

Shelter business growth from excessive taxation

-

Maximize post-sale gains with tax-free withdrawals

-

Utilize depreciation strategies within SDIRAs to offset taxable income

Through alternative investment custody, business owners can manage their private equity stakes, real estate holdings, and other alternative assets inside tax-advantaged accounts, ensuring long-term financial efficiency.

Maximizing Wealth Through Tax-Efficient Investment Vehicles with Alternative Investment Custody

Attendees at the event learned how a well-structured tax strategy incorporating alternative investment custody solutions can significantly impact long-term financial success. The combination of trusts, self-directed custodians, and alternative investment custody provides a powerful framework for individuals and business owners to strategically plan their tax savings.

By integrating these tools, investors can protect their assets, optimize tax outcomes, and ensure a more secure financial future—making alternative investment custody a key component of long-term tax-efficient wealth-building strategies.

01/10/2025, San Ramon CA

Alternative Investment Custody: Real Estate as a Leading Asset Class

Real estate continues to be one of the primary alternative investment asset classes, attracting investors looking for stability, long-term appreciation, and portfolio diversification. The surge in real estate investment took off after the 2008 recession, when property prices remained low for an extended period. Many individual investors entered the real estate market during this time, launching their investment careers. This boom also led to a significant increase in the use of self-directed IRA (SDIRA) accounts through alternative asset custodians, as investors sought tax-advantaged ways to grow their wealth.

Between 2010 and 2020, real estate investments played a critical role in wealth-building strategies. Today, the asset class remains a hot topic, with investors not only viewing it as a diversification tool but also as a path to financial independence. Unlike traditional

Stocks and bonds, real estate provides tangible assets that generate income, appreciate over time, and offer direct control over investment decisions.

Real Estate as a Business Venture

Beyond just an investment, real estate often transforms into an entrepreneurial venture. Many investors operate their portfolios like small businesses, engaging in:

-

Fix-and-flip projects

-

Property renovations and improvements

-

Managing rental properties and tenants

This hands-on approach allows investors to actively build wealth while leveraging their expertise to increase property value.

Real Estate Meetups and Collaborative Investing

Across the country, and particularly in the Bay Area, real estate investors frequently gather at real estate meetups—networking events where they discuss market trends, funding opportunities, and collaborative transactions. These gatherings foster partnerships among investors, brokers, and financial professionals, allowing for:

-

Group funding for real estate deals

-

Sponsorship of investment transactions

-

Exchange of insights and strategies

At recent real estate meetups in the Bay Area, alternative asset custodians have been actively engaging with investors, brokers, and financial professionals. By promoting self-directed IRA custodial services, these custodians help individuals use alternative investment custody solutions to invest in real estate within tax-advantaged accounts. This approach enables investors to maximize their returns while maintaining compliance with IRS regulations.

The Role of Alternative Investment Custodians

For investors looking to purchase real estate within an SDIRA, alternative investment custodians provide the necessary framework to:

-

Hold real estate investments inside retirement accounts

-

Ensure compliance with IRS rules

-

Facilitate transactions and reporting

With real estate remaining a top alternative investment, the role of custodians in streamlining the investment process continues to grow. Investors seeking long-term financial growth and diversification should consider leveraging alternative investment custody to enhance their real estate portfolios.

11/24/2024, San Ramon CA

Lessons from Schwab IMPACT 2024

This year’s Schwab IMPACT conference brought together hundreds of wealth management professionals at the Moscone Center in San Francisco. Held shortly after the presidential elections, the event was abuzz with speculation about the potential market impacts of the political shift. Despite this backdrop, the agenda remained firmly focused on advisor-centric experiences, highlighting the latest trends and innovations in the wealth management industry.

Personalization and Portfolio Diversification Take Center Stage

A recurring theme throughout the conference was the growing importance of creating personalized, goals-based investment solutions for clients. Advisors are moving away from generic investment strategies to focus on tailored portfolios that align with clients' unique objectives, life stages, and risk tolerances.

Portfolio diversification was another hot topic, with discussions emphasizing the need to incorporate a variety of asset classes and strategies. From traditional investments to emerging alternatives, the focus was on building resilient portfolios to weather market volatility and capitalize on growth opportunities.

Technology and Investment Products Dominate the Exhibit Floor

The exhibitor breakdown at Schwab IMPACT 2024 reflected the industry’s priorities. Over 60% of exhibitors

were technology and investment product providers, showcasing the tools and solutions driving the future of

wealth management.

Here’s the full breakdown:

-

Technology Providers: 188

-

Mutual Funds: 94

-

Alternative Investments: 60

-

ETFs: 61

-

Managed Accounts: 70

-

Schwab Advisor Services Providers: 40

-

RIAs: 26

-

Retirement Services: 14

-

Bank/Trust: 14

Technology providers stole the spotlight, offering insights into how digital tools are transforming client interactions, streamlining operations, and enhancing decision-making. The strong presence of investment product providers further underscored the industry’s reliance on innovation to meet evolving client demands.

Challenges in Alternative Investment Distribution

The alternative investments segment, represented by 60 exhibitors, was a major focus of discussions at Schwab IMPACT. Independent providers and rapidly growing marketplaces like Schwab’s One Source, iCapital, and CAIS highlighted the industry's evolution. However, distribution remains a persistent challenge for alternative investments.

For many funds, gaining visibility on custodial platforms and marketplaces comes at a steep cost, with significant listing fees. This has led to a paradox: while marketplaces have expanded access to alternative investments, they’ve also increased distribution costs. Funds now face the dual burden of paying fees to custodians and industry aggregators, adding pressure to their bottom lines.

The Role of Alternative Investment Custodians

Alternative investment custodians were absent from the conference. These custodians offer a streamlined distribution channel for private investment vehicles but still lack the scale and reach of traditional investment platforms. As the alternative investment space continues to grow, the role of custodians may expand, potentially reshaping the distribution landscape and addressing current inefficiencies.

Looking Ahead

Schwab IMPACT 2024 reinforced the wealth management industry’s commitment to innovation, personalization, and diversification. While technology and investment products continue to drive progress, challenges such as efficient distribution in the alternative investment market remain to be addressed.

As the industry evolves, advisors will need to navigate these complexities to deliver value to their clients. Schwab IMPACT 2024 offered a glimpse into the future, emphasizing the importance of adaptability and forward-thinking in shaping the next chapter of wealth manag

11/01/2024, San Ramon CA

iCapital acquires Alts Exchange

The recent acquisition of Alts Exchange (www.altexchange.com) by iCapital (icapital.com) marks another wave of consolidation in the alternative investment industry. Just a few months earlier, SEC (www.seic.com) acquired Altigo (www.altigo.com), a cloud platform for alternative investment inventory, e-subscriptions, and reporting.

Both Alts Exchange and Altigo were once agile, efficient companies connecting mid-sized fund managers and asset allocators. Now, they're part of large, multi-billion-dollar operations, which could shift the industry landscape.

Large firms tend to focus on institutional clients, pursuing big funds and high-value opportunities. As a result, smaller and mid-sized investment managers may find themselves underserved. Many small and mid-sized sponsors avoid large providers for several reasons:

Smaller firms prefer working with similar-sized service providers.

Smaller funds are more cost-conscious and unwilling to overpay for distribution.

-

Large asset allocators often overlook smaller investments due to the extensive due diligence, legal work, and documentation required.

In this changing environment, alternative investment custodians are stepping up. Their role is expanding to include asset performance reporting, tax document automation, and deeper integration with traditional asset management systems—all while maintaining a retail-oriented service model.

Alternative asset custodians play a key role in protecting investments from potential losses. They assist investment managers by handling subscription and core offering documents. By servicing individual investors and financial advisors, alternative investment custodians help small and mid-sized sponsors reach a wider investor audience.

10/11/2024, San Ramon CA

The Evolution of Alternative Investment Custody

The recent ADISA annual conference highlighted a significant shift in the alternative investment custody space. Over the years, the number of custodians participating in the industry has grown, with many becoming major sponsors of the event. These custodians are now playing a pivotal role in driving the development of the entire alternative investment sector.

Traditionally, alternative investment custodians primarily served individual investors, managing self-directed and other tax-advantaged plans. However, their role has evolved into more powerful entities that facilitate investment allocation and distribution on a larger scale.

At the ADISA conference, custodians showcased a broader focus beyond just recordkeeping for self-directed IRAs. They are positioning themselves as integrated players in the investment ecosystem, contributing to the manufacturing and distribution of alternative investments. Their services now include asset aggregation, portfolio reporting, and the promotion of alternative investment marketplaces.

A key indicator of the industry's maturity is the consolidation trend, exemplified by companies like Millennium Trust, now part of Inspire. Inspire has acquired several independent custodians, consolidating accounts and practices to become a major force in the space.

The presence of a full range of infrastructure players at ADISA—such as custodians, transfer agents, and trust companies—demonstrates a solid foundation for the industry's sustainable growth.

Another trend observed at this year’s conference is that large investment sponsors are increasingly listing their private investments on various custodial marketplaces. In the future, the distribution of these alternative investments is expected to become even more streamlined and efficient. Companies are actively working on aggregating alternative investment opportunities, including illiquid private funds. Expanding these marketplaces to accommodate smaller investment opportunities and penetrate deeper into the private market over the next 3 to 5 years could transform the industry further.

09/23/2024, San Ramon CA

Alts Custodian is joining ADISA network

About ADISA (www.adisa.org)

The Alternative & Direct Investment Securities Association (ADISA) is the largest forum for professionals involved in the alternative and direct investment industry. Initially, it served as a hub where sponsors of private real estate investment vehicles could connect with broker-dealers and other institutional distributors of investment products.

Over the years, the range of investment products represented through ADISA has broadened significantly. Today, it includes sectors such as infrastructure, energy, and commodities, as well as more complex pooled investment vehicles like structured investment products and hedge funds.

One of the key attractions for sponsors and managers of non-publicly traded and illiquid investment opportunities is ADISA's focus on providing access to specialized distribution channels, which cater specifically to private placements and alternative investment products.

Alternative Investment Custodians at ADISA

Historically, alternative asset custodians within ADISA have played a pivotal role in servicing individual investors seeking exposure to private and illiquid alternatives, particularly in real estate. Sponsors of multi-tenant residential and commercial properties often looked to raise capital from high-net-worth investors, many of whom accessed these opportunities through alternative asset and self-directed custodians, allowing them to allocate portions of their portfolios to alternative investments.

After the 2008 recession, interest in real estate as an investment class surged. With expectations of significant appreciation in property values, thousands of individual investors began allocating their tax-advantaged investments, such as IRAs, into real estate. During this period, many investment sponsors shifted their focus toward the individual investor market.

The investment landscape has since experienced several waves of transformation throughout the 2010s and 2020s, further elevating the role of alternative asset custodians. These custodians have facilitated private capital inflows from individual (non-institutional) investors into various asset classes, including:

Residential real estate and syndicates (2009-2014)

Precious metals (2011-2016)

Crowdfunding platforms (2012-2018)

Crypto assets (2016-2022)

Registered Investment Advisors at ADISA

Since the mid-2010s, the alternative investment distribution model has gradually shifted from commission-based broker-dealer frameworks to fiduciary models. With growing interest in alternatives from individual investors and their financial advisors, sponsors of non-publicly traded investment opportunities have increasingly focused on working with private capital.

In response to the financial recession and heightened market uncertainty, registered investment advisors (RIAs) have placed greater emphasis on portfolio diversification. Alternative investments have become an essential component of managed portfolios, offering investors exposure to non-traditional asset classes that can hedge against volatility in public markets.

This year, the ADISA conference is expected to see a record number of participants from the financial advisor space, reflecting the increasing role of RIAs in the distribution of alternative investments.

Alternative Investment Custodian Inc (Alts Custodian)

Alternative Investment Custodian Inc (Alts Custodian) plays a pivotal role in assisting financial advisors in smoothly integrating private asset investment strategies into their clients' portfolios. As the demand for portfolio diversification grows, particularly among high-net-worth individuals, advisors are increasingly turning to alternative investments to provide exposure to non-publicly traded assets like real estate, private equity, and other illiquid investments.

Alts Custodian has fully integrated its processes into leading multi-custodial platforms, enabling financial advisors and Registered Investment Advisors (RIAs) to efficiently place client funds into alternative assets. This streamlined integration simplifies the administrative and compliance hurdles traditionally associated with alternative investments, allowing advisors to focus more on strategy and client outcomes.

By leveraging Alts Custodian's platform, advisors can offer their clients broader investment opportunities beyond public markets, enhancing portfolio resilience through diversification. This approach not only helps mitigate market volatility but also allows clients to access sectors that have historically been reserved for institutional investors.

Moreover, with increasing uncertainty in public markets and growing regulatory scrutiny on fiduciary standards, the ability to integrate alternative investments in a compliant and seamless manner is critical. Alts Custodian helps bridge this gap, ensuring that advisors can deliver sophisticated, diversified investment strategies while meeting regulatory obligations.